Cryptocurrencies have taken the world by storm, transforming the way we think about money and financial transactions. Born out of a desire for decentralized, digital currencies, cryptocurrencies have evolved into a multifaceted phenomenon with a complex history and a broad range of applications. In this blog post, we will explore the world of cryptocurrencies, unraveling their nature, purpose, history, and how people can use them to navigate the digital age.

What Are Cryptocurrencies?

Cryptocurrencies, often referred to as “crypto,” are digital or virtual currencies that use cryptography for security. Unlike traditional currencies issued and regulated by governments (fiat currencies), cryptocurrencies are decentralized, relying on a technology called blockchain to maintain their integrity.

The Birth of Bitcoin and the Blockchain Revolution

The history of cryptocurrencies traces back to 2009 when an anonymous individual or group of individuals using the pseudonym Satoshi Nakamoto released Bitcoin, the world’s first cryptocurrency. Bitcoin’s groundbreaking innovation was the blockchain, a distributed ledger technology that records all transactions across a network of computers, ensuring transparency, security, and immutability.

How Cryptocurrencies Work

Cryptocurrencies operate on a decentralized network of computers (nodes) that validate and record transactions on a blockchain. Each transaction is added to a “block” and linked to the previous one, forming a chronological chain of blocks—a blockchain. Miners, individuals or entities with powerful computers, solve complex mathematical puzzles to validate transactions and add new blocks to the chain in exchange for rewards.

What Cryptocurrencies Are For

- Digital Currency: At its core, cryptocurrencies serve as a form of digital money, allowing users to make online transactions, purchases, and payments.

- Investment: Many view cryptocurrencies as an investment opportunity, hoping that their value will appreciate over time, similar to stocks or commodities.

- Financial Inclusion: Cryptocurrencies offer financial services to individuals without access to traditional banking, allowing them to participate in the global economy.

- Smart Contracts: Some cryptocurrencies, like Ethereum, enable the creation of smart contracts—self-executing agreements with predefined rules and conditions.

- Privacy: Certain cryptocurrencies, such as Monero and Zcash, prioritize user privacy by employing advanced cryptographic techniques.

Popular Cryptocurrencies

While Bitcoin remains the most well-known cryptocurrency, thousands of others have emerged, each with unique features and use cases. Ethereum introduced smart contracts, Ripple focuses on cross-border payments, and Litecoin aims to facilitate faster transactions, to name a few.

How to Use Cryptocurrencies

- Get a Wallet: To use cryptocurrencies, you’ll need a digital wallet to store, send, and receive them. Wallets come in various forms, including software, hardware, and paper wallets.

- Acquire Cryptocurrency: You can obtain cryptocurrencies through cryptocurrency exchanges, mining, or as payment for goods and services.

- Make Transactions: Once you have cryptocurrency in your wallet, you can use it to make online purchases, send money to friends and family, or engage in investment and trading activities.

Cryptocurrency Challenges and Concerns

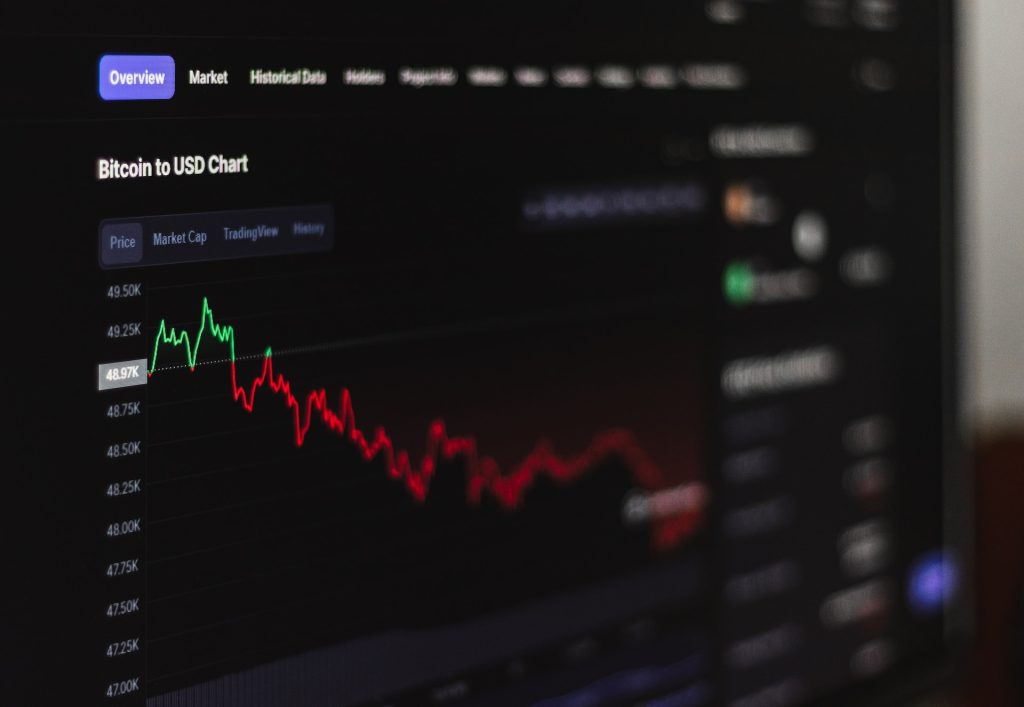

- Volatility: Cryptocurrencies are known for their price volatility, which can make them risky investments.

- Regulatory Uncertainty: The regulatory environment for cryptocurrencies varies by country and is still evolving, creating uncertainty for users and businesses.

- Security Risks: While blockchain technology is secure, individual users must take precautions to protect their wallets and assets from theft or fraud.

The Future of Cryptocurrencies

The future of cryptocurrencies is a topic of debate and speculation. Some envision a world where cryptocurrencies become mainstream and replace traditional banking systems, while others remain skeptical due to regulatory challenges and market volatility.

Cryptocurrencies represent a revolutionary shift in the world of finance and digital technology. They offer new opportunities for financial inclusion, investment, and innovation. While their future remains uncertain, their impact on the global economy and financial landscape cannot be ignored. As we continue to navigate the digital age, understanding cryptocurrencies and their potential applications is essential for staying informed and prepared for the evolving financial landscape.